In today’s financial world, investors and business owners often seek innovative ways to access capital without disrupting their investment portfolios or business operations. One such financial instrument gaining popularity is stock loans. These loans offer a unique way to unlock the value of your stock holdings without having to sell them. But what exactly are stock loans, and how do they work? This article will provide an in-depth exploration of stock loans, covering their mechanisms, advantages, risks, and how they fit into modern financing strategies.

Key Takeaways

- Stock loans allow borrowing against stock holdings without selling shares.

- Loan amounts depend on the loan-to-value ratio and stock quality.

- Borrowers retain ownership and often voting rights on pledged shares.

- Market volatility can trigger margin calls and forced liquidation.

- Stock loans usually feature competitive interest rates and faster approval.

- They provide liquidity for business expansion, investment, or personal needs.

- Understanding loan terms and risks is essential before borrowing.

Understanding Stock Loans

Stock loans have become a powerful financial tool for investors and business owners looking to unlock the value of their stock holdings without selling their shares. To fully grasp how stock loans operate and why they might be beneficial or risky, it’s important to understand their components, mechanisms, and practical considerations.

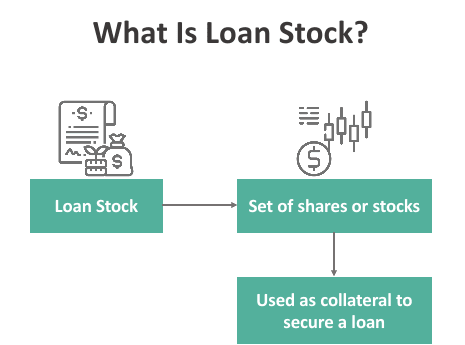

What Are Stock Loans?

Stock loans are a type of secured lending arrangement where borrowers use their shares of stock—usually publicly traded securities—as collateral to borrow money. Rather than selling the stocks to raise cash, the borrower pledges these assets to a lender, receiving a loan amount based on the market value of the pledged securities.

The key feature of stock loans is that they allow borrowers to retain ownership of the stocks while unlocking liquidity. This means the borrower can continue to benefit from dividends and potential capital appreciation while having access to funds for other needs.

How Do Stock Loans Work?

At a high level, stock loans involve the following stages:

Collateral Pledge

The borrower identifies a portfolio of stocks to pledge as collateral. These are typically blue-chip stocks or other highly liquid shares that have a stable market value. The lender assesses the portfolio and decides the acceptable value and risk.

Loan-to-Value Ratio (LTV)

Lenders provide financing based on a loan-to-value ratio, meaning they offer a loan amount that is a percentage of the current market value of the stocks. For example, if the stocks are worth $1 million and the lender offers a 60% LTV, the borrower can receive up to $600,000.

This ratio protects the lender by ensuring the collateral exceeds the loan value, providing a buffer against price drops.

Interest Rates and Fees

The loan carries interest, often lower than unsecured loans due to the collateral’s security. The rates depend on market conditions, loan size, borrower creditworthiness, and the risk profile of the pledged stocks.

There may also be fees such as origination, maintenance, or administrative fees.

Margin Requirements and Maintenance

Because stock values fluctuate, lenders typically require borrowers to maintain a minimum collateral level. If the stock value declines and the LTV ratio worsens (meaning the loan is too large relative to collateral), the lender may issue a margin call. The borrower must then either deposit additional collateral or repay part of the loan to restore the required ratio.

Failure to satisfy margin calls can lead to the lender liquidating the pledged stocks.

Loan Term and Repayment

Stock loans can be short-term or long-term, depending on the agreement. Repayment schedules vary, with options including interest-only payments with principal due at maturity or amortizing payments.

Once the loan is fully repaid, the lender releases the pledged stocks back to the borrower.

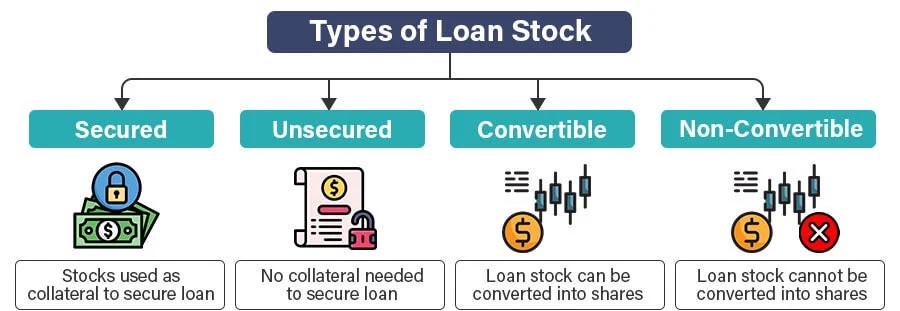

Types of Stock Loans

Stock loans, while unified by the principle of borrowing against stock holdings as collateral, come in several distinct types. Each type has unique characteristics tailored to different borrower needs, risk appetites, and financial goals. Understanding the types of stock loans helps borrowers choose the right option and manage associated risks effectively.

Recourse Stock Loans

What Are Recourse Stock Loans?

Recourse stock loans are loans where the borrower is personally liable beyond just the pledged stock collateral. This means if the borrower defaults and the lender liquidates the collateral but the sale proceeds do not cover the outstanding loan balance, the lender can seek repayment from the borrower’s other assets.

How Do They Work?

- The borrower pledges stocks as collateral.

- The lender provides a loan based on a percentage of the stock’s market value.

- If the borrower fails to repay, the lender sells the pledged stocks.

- If the sale proceeds are insufficient, the lender pursues the borrower for the remaining balance.

Advantages

- Typically offer higher loan-to-value (LTV) ratios.

- Interest rates tend to be lower due to increased borrower risk.

- More flexible loan terms and conditions.

Risks and Considerations

- Borrower bears personal liability beyond collateral.

- Potentially greater financial risk in the event of a market downturn.

- Requires strong creditworthiness.

Non-Recourse Stock Loans

What Are Non-Recourse Stock Loans?

Non-recourse stock loans limit the lender’s recovery to the pledged stocks only. The borrower is not personally liable if the collateral is insufficient to cover the loan. In case of default, the lender can seize and sell the collateral but cannot pursue the borrower’s other assets.

How Do They Work?

- Stocks are pledged as collateral.

- The lender offers a loan at a lower LTV ratio to account for risk.

- Borrower is protected from further liability beyond the collateral.

Advantages

- Limits borrower’s downside risk to the pledged stocks.

- Provides peace of mind for investors wary of personal liability.

- Suitable for borrowers who want to protect other assets.

Risks and Considerations

- Lenders typically offer lower loan amounts.

- Interest rates may be higher to compensate for greater risk.

- Loan terms may be stricter, with more frequent margin calls.

- Market volatility remains a risk for collateral value.

Margin Loans

What Are Margin Loans?

Margin loans are a specific type of stock loan primarily offered by brokerage firms. Investors use their existing stock portfolios as collateral to borrow money to purchase additional securities, thereby leveraging their investments.

How Do They Work?

- An investor pledges stocks held in a brokerage account.

- The brokerage lends a percentage of the portfolio value.

- Borrowed funds are used to buy more securities.

- The investor must maintain minimum margin requirements.

- Margin calls may be triggered by stock price declines.

Advantages

- Enables investors to increase their purchasing power.

- Can amplify gains in rising markets.

- Interest rates are often competitive within brokerage terms.

Risks and Considerations

- High risk due to market volatility and margin calls.

- Forced liquidation can occur rapidly.

- Interest can compound quickly, magnifying losses.

- Not suitable for risk-averse investors.

Securities-Based Loans (SBLs)

What Are Securities-Based Loans?

Securities-Based Loans (SBLs) are a broader category of loans secured by various types of securities, including stocks, bonds, mutual funds, and ETFs. These loans are structured by financial institutions to provide liquidity based on a diverse portfolio of assets.

How Do They Work?

- Borrowers pledge a diversified securities portfolio.

- Lenders calculate loan amounts based on portfolio value and risk.

- Terms vary widely depending on collateral composition.

Advantages

- Diversification reduces risk compared to single-stock loans.

- Flexible loan sizes and repayment terms.

- Often integrated with wealth management services.

Risks and Considerations

- Portfolio volatility still impacts loan terms.

- Complex valuations require professional management.

- Possible restrictions on securities eligible as collateral.

Private Stock Loans

What Are Private Stock Loans?

Private stock loans involve pledging shares of privately held companies as collateral. These loans are less common and generally involve customized agreements due to the illiquid nature of private stock.

How Do They Work?

- Valuation of private shares is based on appraisals or recent transactions.

- Lenders typically offer lower LTV ratios due to illiquidity.

- Terms are negotiated case-by-case.

Advantages

- Provides liquidity options for private company shareholders.

- Enables financing without selling private shares.

- Can support business expansion or shareholder liquidity needs.

Risks and Considerations

- Lack of market liquidity makes collateral riskier.

- Valuation disputes can complicate loan terms.

- Higher interest rates and fees due to increased risk.

Stock Loan Programs for Business Owners

What Are Stock Loans for Business Owners?

Business owners often use stock loans as a form of secured business loan, leveraging their stock holdings to fund business operations, expansion, or capital investments without diluting equity.

How Do They Work?

- Business owners pledge personal or company stock as collateral.

- Loan proceeds are injected into the business or used for other corporate needs.

- Terms are tailored to align with business cash flow and risk.

Advantages

- Maintains business and ownership control.

- Provides fast access to capital for business growth.

- Avoids selling equity or taking on unsecured debt.

Risks and Considerations

- Business cash flow must support loan servicing.

- Market declines can jeopardize both personal wealth and business financing.

- Coordination with business and personal financial planning is critical.

Summary Comparison of Stock Loan Types

| Type | Borrower Liability | Typical LTV Ratio | Interest Rate | Collateral Liquidity | Risk Level |

|---|---|---|---|---|---|

| Recourse Stock Loans | Personal Liability | 60% – 70% | Lower | High | Moderate |

| Non-Recourse Stock Loans | Limited to Collateral | 50% – 60% | Higher | High | Lower personal risk |

| Margin Loans | Personal Liability | Up to 50% | Variable | High | High (volatile market) |

| Securities-Based Loans | Varies | 50% – 70% | Varies | Diversified | Moderate |

| Private Stock Loans | Varies | 30% – 50% | Higher | Low (illiquid) | Higher risk |

| Business Owner Stock Loans | Varies | Varies | Varies | High (public/private) | Moderate |

Who Uses Stock Loans?

Stock loans are popular among various types of borrowers:

- Individual Investors: Seeking liquidity without selling appreciated stocks, avoiding capital gains taxes.

- Business Owners: Using stock loans as a form of secured business loan to finance operations or expansion.

- Entrepreneurs: Needing fast capital for investment or opportunity without diluting ownership.

- High Net-Worth Individuals: Managing wealth efficiently while accessing funds for lifestyle or tax planning.

- Institutional Investors: Using stock loans to leverage portfolios or optimize capital structure.

Key Features and Components of Stock Loans

- Collateral: Stocks are the primary collateral; quality and liquidity matter greatly.

- Loan Amount: Based on LTV ratios, typically ranging from 50% to 70%.

- Interest Rate: Lower than unsecured loans but variable depending on risk.

- Term Length: Can be flexible, from a few months to several years.

- Margin Call Mechanism: Protects lenders from collateral value declines.

- Ownership and Voting Rights: Usually retained by the borrower unless otherwise specified.

- Restrictions: Borrowers may face limitations on selling or transferring pledged stocks during the loan.

Advantages of Stock Loans

- Access liquidity without selling stock and triggering taxable events.

- Competitive interest rates due to secured collateral.

- Maintain voting rights and dividends from pledged shares.

- Fast approval due to transparent collateral valuation.

- Flexibility in fund use, including business or personal needs.

Risks and Challenges of Stock Loans

Restrictions on stock sales can limit portfolio management flexibility.

Market volatility can cause margin calls or forced liquidation.

Borrowers risk losing stocks if unable to repay or meet margin requirements.

Interest costs and fees may accumulate, especially on long-term loans.

Complex terms require careful legal and financial review.

How Do Stock Loans Work?

The process behind stock loans involves several key steps and mechanisms:

Collateral Evaluation

Lenders start by evaluating the stocks you want to pledge. They focus on the liquidity, volatility, and market capitalization of the stocks. Blue-chip stocks or highly liquid shares with steady price histories are preferred. Stocks that are volatile or illiquid may not qualify or will have a lower loan-to-value ratio.

Loan Approval and Terms

Once the collateral is evaluated, the lender offers a loan based on a percentage of the collateral’s value. This loan will come with an agreed interest rate, repayment schedule, and other terms such as margin requirements.

Disbursement of Funds

After signing the agreement, the loan amount is disbursed to the borrower, usually quickly due to the low risk associated with liquid collateral.

Maintaining Collateral Value

Stock loans generally require the borrower to maintain a minimum collateral level. If the value of the stocks drops below this threshold, the lender may issue a margin call, requiring the borrower to add more collateral or repay part of the loan to maintain the agreed loan-to-value ratio.

Repayment and Release of Collateral

When the loan is repaid, either partially or in full, the pledged stocks are released back to the borrower. If the borrower fails to repay or meet margin calls, the lender has the right to liquidate the pledged stocks to recover the loan balance.

Benefits of Stock Loans

Stock loans provide several important benefits that make them attractive for certain borrowers:

Access to Liquidity Without Selling Shares

One of the primary advantages of stock loans is the ability to access cash without selling your stock holdings. This means you can avoid capital gains taxes and continue to benefit from future appreciation and dividends.

Competitive Interest Rates

Because stock loans are secured by valuable collateral, they often come with lower interest rates compared to unsecured loans or credit products.

Flexible Use of Funds

The money from stock loans can be used for virtually any purpose — from expanding a business to covering unexpected personal expenses.

Retain Ownership and Voting Rights

Borrowers maintain ownership of their stocks and often retain voting rights, allowing them to participate in shareholder decisions.

Speed of Access to Funds

Since the collateral is liquid and easy to value, stock loans are usually approved and funded faster than many traditional loans.

Risks and Considerations of Stock Loans

While stock loans offer many advantages, borrowers should be aware of certain risks and considerations:

Market Volatility and Margin Calls

The biggest risk arises from market fluctuations. If the value of pledged stocks drops significantly, lenders can issue margin calls. Failure to meet these calls may result in forced liquidation of stocks at unfavorable prices.

Interest and Fees

Even though rates are competitive, interest and additional fees can accumulate, making stock loans costly if held for long durations.

Loss of Collateral

If the borrower defaults, the lender can liquidate the pledged stocks, resulting in the loss of your investment.

Complex Terms

Loan agreements may contain complex terms regarding margin requirements, recourse rights, and collateral restrictions. It is important to fully understand these terms before proceeding.

How Stock Loans Compare to Other Financing Options

Compared to unsecured loans, credit cards, or even traditional secured business loans, stock loans offer faster access, lower interest rates, and the ability to maintain ownership of your assets. However, unlike real estate-backed loans, stock loans carry market risk due to volatility. They offer a unique balance of liquidity and control, making them suitable for investors and businesses with significant stock holdings.

Also Read: Which Car Loan Company Offers the Best Deals for You?

Common Uses of Stock Loans

Stock loans serve a variety of financial purposes:

- Financing business operations or expansions

- Funding new investments without liquidating portfolios

- Managing personal financial needs or emergencies

- Leveraging investments to increase buying power

- Bridge financing before longer-term loans

Conclusion

Stock loans offer a flexible, efficient way to unlock liquidity tied up in stock portfolios without the need to sell assets. By pledging stocks as collateral, borrowers can access funds quickly, benefit from lower interest rates, and retain ownership of their shares. However, stock loans come with market risks, particularly the potential for margin calls and forced liquidations if stock prices fall.

Before opting for a stock loan, borrowers should carefully consider their financial situation, understand the loan terms, and be prepared to manage collateral risks. When used thoughtfully, stock loans can be a powerful tool for investors and business owners alike to enhance financial flexibility and seize opportunities without sacrificing long-term investment potential.

FAQs

What kinds of stocks can be used as collateral for stock loans?

Lenders typically accept highly liquid, blue-chip stocks listed on major exchanges. Stocks with high volatility or low market capitalization may be excluded or have lower loan-to-value ratios.

How much can I borrow against my stocks?

Loan amounts usually range from 50% to 70% of the current market value of the pledged stocks, depending on lender policies and stock quality.

Do I lose ownership of my stocks when I take a stock loan?

No. You retain ownership and often voting rights, but the stocks are pledged as collateral, restricting sale or transfer until the loan is repaid.

What happens if my stock portfolio value declines?

If the value drops below required thresholds, you may receive a margin call to provide additional collateral or repay part of the loan. Failure to comply can lead to forced liquidation.

Are stock loans taxable?

Stock loans themselves are not taxable events since you’re not selling shares. However, consult a tax advisor for advice on interest deductibility and related tax matters.

How fast can I get a stock loan?

Stock loans can be approved and funded rapidly—often within days—due to the ease of valuing the collateral.

Can I repay the stock loan early?

Many lenders allow early repayment without penalty, but it’s important to confirm terms before committing.