Starting a restaurant is a thrilling venture filled with both opportunity and challenges. One of the biggest hurdles many aspiring restaurant owners face is securing the right financing to launch or grow their business. Navigating through the myriad of financial products available can be overwhelming, especially for startups. The right restaurant loan can provide the necessary capital to get your business up and running, help with equipment purchases, cover renovation costs, or manage cash flow in those critical early days.

This article explores various restaurant loan options ideal for startups, providing clarity on which loans might suit your needs best, the pros and cons of each, and key considerations to make before applying. By understanding your options, you can make informed decisions to set your restaurant on the path to success.

Key Takeaways

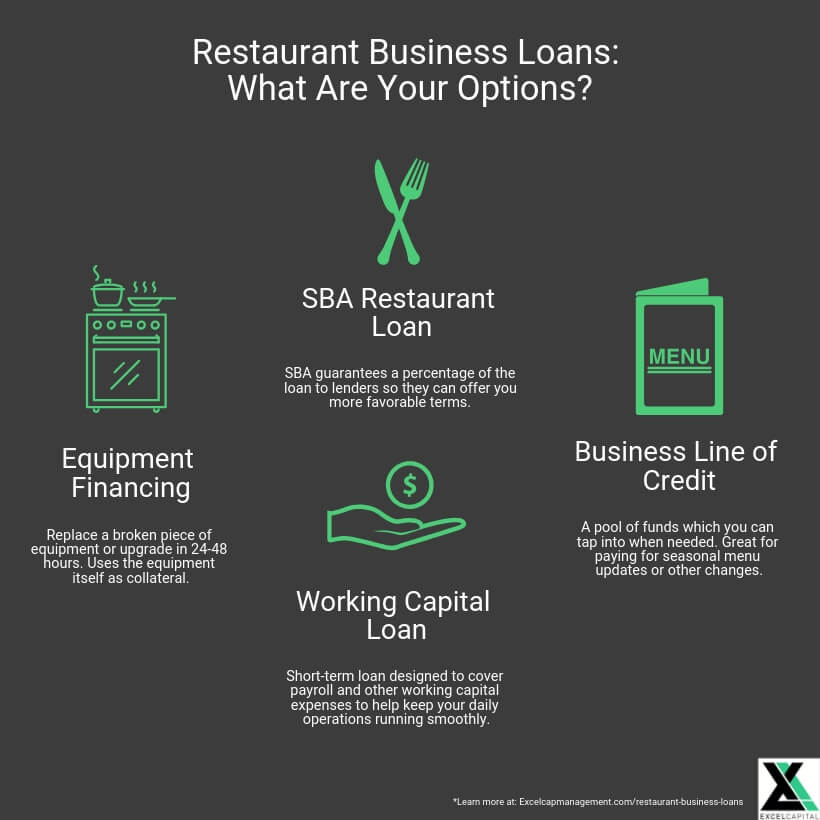

- Restaurant loans provide vital capital to startups for equipment, renovations, and operational costs.

- Secured loans generally offer lower interest rates but require collateral.

- SBA loans provide government-backed support with favorable terms but longer approval times.

- Equipment financing is tailored to acquiring kitchen assets and often secured by the equipment itself.

- Business lines of credit offer flexibility for cash flow management.

- Thorough preparation and understanding of loan terms improve approval chances and loan effectiveness.

- Managing your loan responsibly helps build business credit and fosters long-term success.

Understanding the Basics of a Restaurant Loan

When embarking on the journey to start or expand a restaurant, one of the foundational steps is securing the right financing. A restaurant loan is a specialized financial product designed to cater to the unique needs of the foodservice industry. Understanding what a restaurant loan entails is crucial for startups, as it helps clarify how much capital you can access, what terms to expect, and how the financing can support your business goals.

At its core, a restaurant loan is a sum of money borrowed from a lender to be used for various restaurant-related expenses. These expenses might include purchasing kitchen equipment, renovating the dining area, hiring staff, buying inventory, marketing, or managing everyday operational costs. The loan amount, interest rates, repayment schedule, and eligibility criteria vary widely depending on the type of loan and lender.

There are two main categories of restaurant loans: secured and unsecured. A secured restaurant loan requires collateral, which could be anything valuable such as property, equipment, or even future receivables. The collateral provides security to the lender, lowering their risk and often resulting in better interest rates and higher loan amounts for the borrower. On the other hand, unsecured restaurant loans don’t require collateral but usually have higher interest rates and stricter lending requirements.

Startups often face challenges in securing a restaurant loan because they lack a proven business track record, steady cash flow, or sufficient collateral. However, lenders recognize the potential of new businesses and offer various loan programs specifically designed to accommodate startups, such as Small Business Administration (SBA) loans, microloans, and equipment financing.

Another important aspect of a restaurant loan is the repayment structure. Depending on the loan type, repayments could be fixed monthly installments, variable rates tied to sales, or even revolving credit lines. Understanding these structures helps startups forecast their financial obligations and maintain healthy cash flow.

Ultimately, securing the right restaurant loan is about matching your startup’s financial needs and capacity with the loan option that offers the best terms and conditions. By understanding the basics of a restaurant loan, entrepreneurs can approach lenders with confidence, prepare strong applications, and set their business on the path to sustainable growth.

Types of Restaurant Loans Ideal for Startups

There are several types of restaurant loans that startups should consider. Each comes with distinct features and benefits depending on your business situation, credit profile, and capital needs.

Secured Business Loan

A secured business loan requires collateral, such as property, equipment, or other assets, which the lender can claim if you default. Because the lender’s risk is reduced, secured loans often offer lower interest rates and higher borrowing limits compared to unsecured options. For startups with valuable assets, this loan can be an excellent way to access substantial funding.

Unsecured Business Loan

An unsecured restaurant loan does not require collateral but generally has higher interest rates and stricter approval criteria. It can be a useful option for startups without assets but with strong credit or promising business plans. The amounts are usually smaller, making it suitable for covering working capital or minor renovations.

Small Business Administration (SBA) Loan

The SBA offers loan programs to support small businesses, including restaurants. These loans are partially guaranteed by the government, making lenders more willing to offer favorable terms to startups. SBA loans often have competitive interest rates and long repayment periods, but the application process can be lengthy and requires detailed documentation.

Equipment Financing

Restaurant startups often require expensive kitchen equipment, which can be financed through equipment loans or leases. Typically, the equipment itself serves as collateral, effectively making this a type of secured restaurant loan. This option allows startups to spread out the cost of essential assets while preserving cash flow.

Business Line of Credit

A business line of credit is a flexible financing option where you can draw funds up to a preset limit and repay them as needed. Some lines of credit are secured, while others are unsecured. For restaurants, a line of credit can help manage day-to-day expenses, seasonal fluctuations, or unexpected costs.

Merchant Cash Advance

Merchant cash advances provide upfront capital in exchange for a percentage of future sales. This is generally an unsecured loan with high interest rates and fees, making it a costly but quick option for startups with immediate cash needs.

Microloans

Microloans are smaller loans provided by nonprofits or government programs aimed at startups or underserved businesses. They often have lower qualification barriers but smaller amounts, making them suitable for startups needing limited capital.

How to Choose the Ideal Restaurant Loan for Your Startup

Choosing the best restaurant loan requires a deep understanding of your startup’s needs, financial health, and future plans. Here are several factors to consider:

- Loan Amount: Determine how much capital you actually need. Avoid over-borrowing, which can create unnecessary debt.

- Interest Rates: Lower rates reduce your overall cost of borrowing. Secured loans often provide the best rates.

- Repayment Terms: Longer repayment periods lower monthly payments but increase total interest paid. Shorter terms reduce interest but require higher monthly payments.

- Collateral Requirements: Assess if you have assets to secure a loan or if unsecured options better suit your situation.

- Approval Time: Some loans, like SBA loans, may take longer to approve, which can be a problem if you need funds quickly.

- Lender Reputation: Research lenders thoroughly to avoid predatory terms or hidden fees.

- Flexibility: Some loans allow you to use funds for a variety of purposes, while others are restricted.

Advantages of Restaurant Loans for Startups

Starting a restaurant is a capital-intensive endeavor, requiring substantial upfront investment and ongoing operational funding. For many startups, self-financing or relying solely on personal savings isn’t enough to cover these costs. This is where restaurant loans become invaluable. By accessing the right financing, startups can gain a variety of advantages that contribute to their growth and sustainability. Here’s a detailed look at the key benefits of restaurant loans for new businesses:

Access to Essential Capital

One of the most obvious advantages of a restaurant loan is access to necessary funds that enable startups to cover crucial expenses. These expenses include leasing or purchasing property, renovating the dining and kitchen areas, buying high-quality kitchen equipment, and stocking inventory. Without adequate capital, launching or expanding a restaurant can be severely delayed or compromised.

Improved Cash Flow Management

Running a restaurant involves juggling variable costs such as food supplies, labor wages, and utilities. A restaurant loan can provide a financial cushion to smooth out these fluctuations, especially in the early months when revenue streams are unstable. Having access to working capital ensures your startup can cover day-to-day expenses without sacrificing quality or customer experience.

Ability to Invest in Quality Equipment and Technology

Modern restaurants rely heavily on specialized kitchen equipment, point-of-sale (POS) systems, and inventory management software. A loan can provide the funds needed to invest in these essential tools, which can enhance operational efficiency, reduce waste, and improve service speed—key factors in building a competitive edge.

Opportunities for Renovation and Branding

Creating an inviting atmosphere that reflects your restaurant’s brand is crucial for attracting and retaining customers. Financing through a restaurant loan enables startups to invest in interior design, signage, and marketing efforts that establish a strong market presence and memorable customer experience.

Building Business Credit

Successfully managing and repaying a restaurant loan helps startups establish and improve their business credit profile. Good credit standing opens doors to better financing options in the future, with more favorable interest rates and terms, aiding in further growth and expansion.

Flexibility in Financing Options

The variety of restaurant loan products available allows startups to choose solutions tailored to their specific needs. Whether it’s a secured loan for larger capital needs, an SBA loan with longer repayment terms, or equipment financing tied directly to assets, the flexibility makes it easier for startups to find the right fit.

Enabling Marketing and Staff Hiring Efforts

Launching a new restaurant requires investment in marketing campaigns to build awareness and attract customers. Additionally, hiring and training skilled staff is critical to delivering high-quality service. A restaurant loan can cover these important operational investments, which are often challenging to fund from day-to-day cash flow.

Supporting Growth and Expansion Plans

Once a startup has established itself, restaurant loans can fuel expansion by financing new locations, upgrading facilities, or diversifying menu offerings. Having access to capital empowers restaurateurs to seize growth opportunities and adapt to changing market demands.

In summary, a well-chosen restaurant loan provides startups with the financial foundation to not only launch their business but also to maintain operational stability and plan for future growth. The infusion of capital, combined with the ability to manage cash flow and invest strategically, gives startups a vital advantage in the competitive restaurant industry.

Common Challenges Faced by Restaurant Startups in Securing Loans

Startups often encounter obstacles when seeking restaurant loans:

- Lack of business credit history makes lenders wary.

- Insufficient collateral limits access to secured loans.

- Poor personal credit can impact approval chances.

- High debt-to-income ratios may make lenders hesitant.

- Complex application processes and documentation requirements.

- Short operating history reduces lender confidence.

Tips for Successfully Applying for a Restaurant Loan

Applying for a restaurant loan can be a complex process, especially for startups navigating financial hurdles for the first time. However, with the right preparation and approach, you can significantly improve your chances of approval and secure favorable loan terms that will support your restaurant’s growth. Here are essential tips to guide you through a successful restaurant loan application:

Develop a Comprehensive Business Plan

Lenders want to see a clear roadmap of your restaurant’s vision and financial outlook. Your business plan should detail your concept, target market, competitive analysis, marketing strategy, and realistic financial projections. Demonstrating a thorough understanding of your market and how you plan to achieve profitability reassures lenders of your business’s potential success.

Organize All Financial Documentation

Prepare and present all necessary documents meticulously. These typically include personal and business tax returns, bank statements, profit and loss statements, cash flow forecasts, and any existing debt schedules. Having your paperwork ready and accurate not only speeds up the loan process but also reflects professionalism.

Maintain a Strong Personal and Business Credit Score

Credit scores are critical in loan approvals, especially for startups without an established business credit history. Check your credit reports beforehand, resolve any discrepancies, and work on improving your score by paying down debts and avoiding new credit inquiries. A higher credit score can lead to better interest rates and terms on your restaurant loan.

Choose the Right Type of Restaurant Loan

There is no one-size-fits-all when it comes to loans. Evaluate whether a secured loan, unsecured loan, SBA loan, equipment financing, or business line of credit aligns best with your needs. Matching your capital requirements, repayment capacity, and collateral availability with the right loan type increases your approval odds.

Shop Around and Compare Lenders

Don’t settle for the first loan offer you receive. Different lenders have varying criteria, fees, interest rates, and terms. Reach out to multiple financial institutions, including traditional banks, credit unions, online lenders, and specialty restaurant financing firms. Comparing options ensures you secure the most competitive and suitable loan for your startup.

Be Transparent and Honest with Lenders

Open communication builds trust. Clearly explain your business situation, including any challenges or past financial difficulties. Lenders appreciate honesty and are more likely to work with you if they understand your circumstances fully.

Showcase Your Industry Experience

If you or your management team have prior experience in the restaurant or hospitality industry, highlight this in your application. Demonstrating relevant expertise reassures lenders that your startup is backed by knowledgeable leadership capable of steering the business toward success.

Prepare for Collateral Evaluation (If Applicable)

If applying for a secured restaurant loan, be ready for lenders to assess the value of your collateral assets. Keep documentation on hand that proves ownership and valuation of property, equipment, or other assets you intend to use as security.

Plan for a Realistic Repayment Strategy

Lenders want to see that you can comfortably meet loan repayments. Use your financial projections to develop a realistic repayment plan that considers fluctuating restaurant revenues and seasonal trends. Demonstrating financial prudence can make your application more appealing.

Seek Professional Guidance

If you’re unfamiliar with loan processes or financial statements, consider consulting with a business advisor, accountant, or loan specialist. Professional help can improve your application quality and increase your chances of securing the loan.

By following these tips, you not only enhance your chances of getting approved for a restaurant loan but also position your startup for financial stability and long-term success. Preparation, transparency, and understanding your financial needs are key to navigating the lending process effectively.

Also Read: What Are Stock Loans and How Do They Work?

Conclusion

Securing the right restaurant loan is a critical step for startups aiming to establish or grow their foodservice business. While each loan option offers distinct advantages and challenges, startups should carefully evaluate their financial situation, creditworthiness, and business goals before deciding.

Secured loans, SBA loans, and equipment financing often provide favorable terms and sufficient capital to set a solid foundation for your restaurant. Meanwhile, unsecured loans, lines of credit, and merchant cash advances offer flexibility and speed but often at a higher cost.

By choosing the right restaurant loan and managing it responsibly, your startup can overcome financial hurdles, invest in growth, and ultimately thrive in the competitive restaurant industry.

FAQs

What is a restaurant loan, and why is it important for startups?

A restaurant loan is a financing option designed to meet the specific needs of restaurant businesses. It is essential for startups to access capital needed for equipment, renovations, staff, and other operational costs.

How much can I borrow with a restaurant loan?

Loan amounts vary depending on the lender, loan type, creditworthiness, and collateral. Secured loans generally allow for higher amounts, while unsecured loans or microloans tend to be smaller.

What is the difference between secured and unsecured restaurant loans?

Secured loans require collateral to back the loan, reducing lender risk and often offering better terms. Unsecured loans do not require collateral but come with higher interest rates and stricter approval criteria.

Are SBA loans a good option for restaurant startups?

Yes, SBA loans often have competitive rates and longer repayment terms, making them attractive for startups. However, the application process can be lengthy.

Can I get a restaurant loan with bad credit?

It can be challenging, but some lenders specialize in loans for borrowers with poor credit. These often come with higher interest rates and less favorable terms.

How quickly can I get a restaurant loan approved?

Approval times vary: some loans can be approved in days, while SBA loans and secured loans might take several weeks or months.

What can I use a restaurant loan for?

Funds from a restaurant loan can be used for equipment purchases, renovations, inventory, staffing, marketing, and other business expenses.